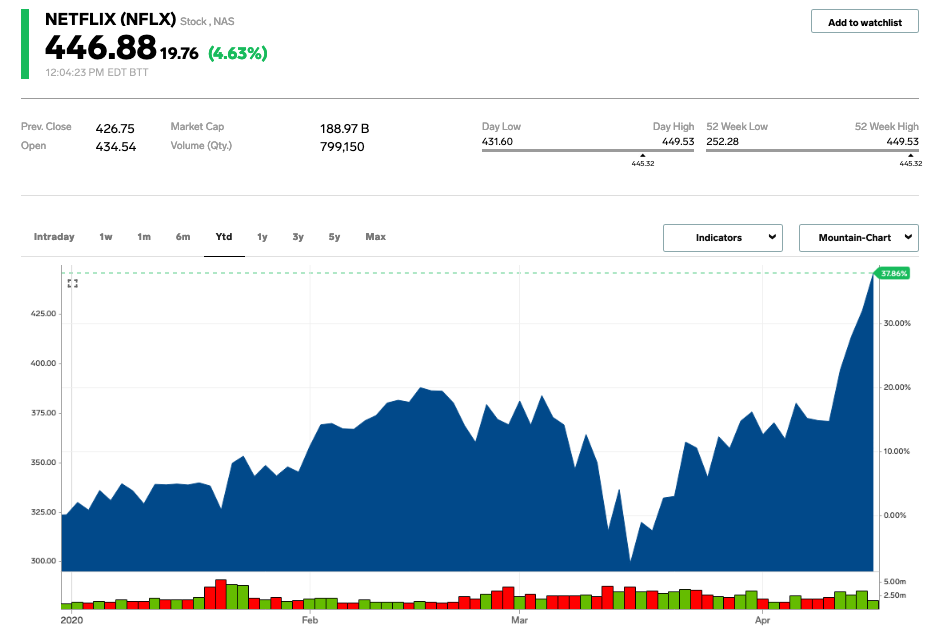

Netflix stocks soared to a record high of $449 per share Thursday after gaining approximately 20 percent through the week’s strong need and praise from analysts.

A price-target increase from Goldman Sachs helped push stocks up to 5.3% greater in Thursday trading.

Since most stocks have just begun clawing their way to pre-pandemic highs, Netflix recently joined the little club of shares to soar amid worsening economic problems.

Monday saw the inventory gain more than 7 percent despite a market recession that was extensive, gains were fueled by, and a mixture of investor confidence and compliments from analysts.

Tuesday and Wednesday saw stocks jump about 4.2 percent and 3.2 percent as market rebounds and discerning buying helped firms best positioned to increase amid coronavirus lockdowns.

Amazon likewise posted multiple listing highs throughout the week as the need for internet shopping skyrockets.

The entertainment giant is up about 38% Nominal, compared with the 13% slump in 2020 of all the S&P 500.

Bank analysts boosted their price goal to 490 on Thursday for Netflix, naming it among the companies seeing need during social distancing.

Popular new programming such as”Tiger King,” along with a third installment of “Ozark,” further raised shares.

“Content development, together with the value of Netflix’s library combined with people remaining home throughout the COVID-19 catastrophe, drove this outperformance.

The health catastrophe can be accelerating the years-long change from conventional content outlets such as TV and film theaters to streaming solutions, the analysts said. Netflix’s standing as the earliest and most recognized firm in the section sets up it for fostered subscriber expansion both from the immediate and long term, Goldman said.

Markets Insider